Broker Account – Trade Republic

€0,00

Trade Republic is a mobile-based social trading platform that takes pride in providing easy, fast and free access to capital markets. The company has about 1 million customers on board, € 6 billion assets under management and is rated 4.5 stars on Trustpilot. The Trade Republic mobile app is available for all German investors to trade shares, ETFs, bonds and other commodities.

- Convenient trading via mobile app

- Flat fee of 1€ per order (ETF, share, etc.) regardless of the order volume

- Quick and responsive customer support

- Users can trade various products as the company provides more than 7300 assets, including ETFs, bonds and shares.

Trade Republic acts as a better alternative to banks by offering excellent and simple products that everyone can afford. They also secure clients’ money and protect their wealth. The Trade Republic mobile app is available for all German investors to trade shares, ETFs, bonds and other commodities. Users of Trade Republic, however, lack the robustness and customizability that desktop platforms offer. They also lack the majority of European stocks and can only trade a limited variety of cryptocurrencies. Trade Republic provides several advantages to its users despite the obvious challenges.

- A better alternative to banks that makes trading securities possible from mobile platforms.

- Users enjoy the assurance of trading with a licensed, legal and certified banking organization.

- Trade Republic collaborated with several major Banking and Investment corporations throughout Germany to create a seamless trading experience for their users. The corporations include Solarisbank Ag, HSBC Germany, Blackrock and the Lang and Schwarz Exchange.

- Quick and responsive customer support: the customer support department offers quick and excellent services through email, live chat and phone call.

- Users can trade various products as the company provides more than 7300 assets, including ETFs, bonds and shares.

How to Sign Up

- Download the mobile app and click the sign-up button.

- Enter the required details in the registration form, including personal data such as names, mobile number and address.

- Confirm your identity through a video chat using valid identification documents.

- Enter the code sent to your registered mobile number.

- Provide responses regarding your experience and knowledge in trading securities and submit.

The sign-up process is relatively long as compared to other brokers; however, it does not take longer than 15 minutes. There are also basic requirements that German users must meet to create a Trade Republic account successfully.

- The user must be of legal age and taxable in Germany.

- The user must have a SEPA bank account.

- The user must have a German mobile number.

- The user must have a permanent residence in Germany and hold a passport or Identity card.

- The user must have a smartphone with iOS or Android operating system.

Pricing and Fees

Trade Republic offers transparent and competitive pricing for various products. The company frees users from high trading costs to encourage investment into the capital markets. Furthermore, the company aims to revolutionize securities trading in Germany by reducing costs.

Fees

- € 1 flat fee for any order regardless of the trade volume.

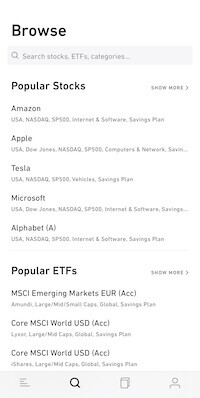

- Order commission and savings plan purchase of ETF or stock are free of charge. However, each order should be at least € 10 and at most € 5000.

- No deposit, withdrawal or inactivity fees.

- € 25 for placing orders by post and transferring orders by letter.

Since postal order placement costs € 25, users can opt to use the mobile app for placing orders. Other services that are free of charge include:

- Shares dividend payment.

- ETF distribution.

- Annual tax certificate.

- Custody and account statement.

- Participation in corporate actions.

Benefits of Using Trade Republic.

- Commission-free trading on all assets.

- No minimum deposit hence making it easier for customers to begin investing.

- Users can enjoy the long-term offer of zero-fee saving with over 9000 stocks, ETFs and derivatives.

- Easy-to-use and secure mobile platform.

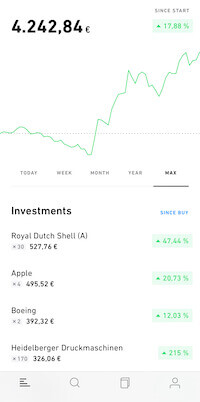

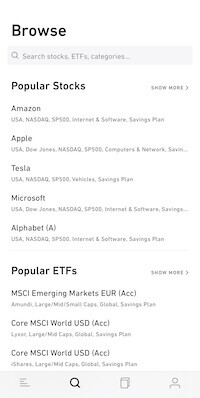

- Wide variety of assets: offers over 6000 stocks covering Germany, Europe and the United States. Among the prominent international stocks traded on the platform include Apple, BMW and Barrick Gold.

Trade Republic customers can access various tradable asset classes, including cryptocurrency, derivatives and exchange-traded securities. Investors can trade these asset classes using limit orders, market orders and stop orders.

- Strategic business partnerships with major banking and financial organizations such as Solarisbank AG and HSBC boost customer confidence and assurance of safety and regulation.

- Trade Republic legally owns a banking license hence can serve as securities trading bank and a broker.

- Trade Republic offers a single account type, which makes it easier to trade in all asset classes.

It is important to note that Trade Republic supports limited withdrawal and account funding options. However, the bank transfer option usually takes one to three business days to clear payments and should suffice for most users. Credit cards, debit cards, Apple Pay and Google Pay options are supported as well and clear payments faster. Furthermore, the lack of a demo account makes it harder for beginners to learn and test new ideas on the platform.

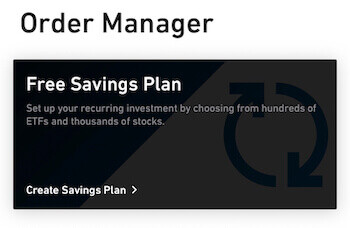

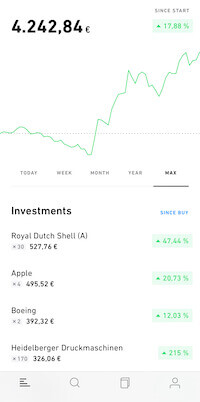

Mobile App

Trade Republic provides a mobile-only trading platform. The mobile app is free and available in the App Store and Play Store. The android and IOS apps are thoughtfully designed and provide an excellent user experience. However, there are limited technical and fundamental analysis tools and educational resources that exist in most desktop trading platforms.

Documentation Needed.

Trade Republic requires users to verify their accounts before beginning to trade. The following documentation is required to prove identity and physical address.

- For identity verification, a Passport or ID card is needed.

- For address verification, a phone or internet bill is required.