€3,00

Tomorrow is a German-based sustainable mobile banking platform that’s available in both English and German. They offer a fully digital banking experience along with a well designed banking app where you can easily monitor and control your account. Their product is comparable to most modern digital banks, however, they differentiate themselves as an ethical digital bank that offers the first climate-neutral bank account.

Benefits:

Go to Tomorrow

Tomorrow is a mission-driven company that focuses on climate protection and sustainability. Unlike traditional banks, Tomorrow has committed itself to only investing funds towards projects that aim to positively impact the environment.

They offer a digital banking platform for everyday banking needs. You can access your account through their website or mobile app. You can enable contactless payments with Apple Pay or Google Pay.

This debit account is great for everyday needs, for example, if you need to pay for something at the store, if you need to transfer money to another account, or if you need to withdraw cash.

If you have savings goals, they have a nice feature that allows you to allocate money to different savings „pockets“.

You will also have peace of mind knowing that with each purchase you make, the majority of the interchange fee (a fee that every bank charges the store) will go towards the Tomorrow climate contribution fund.

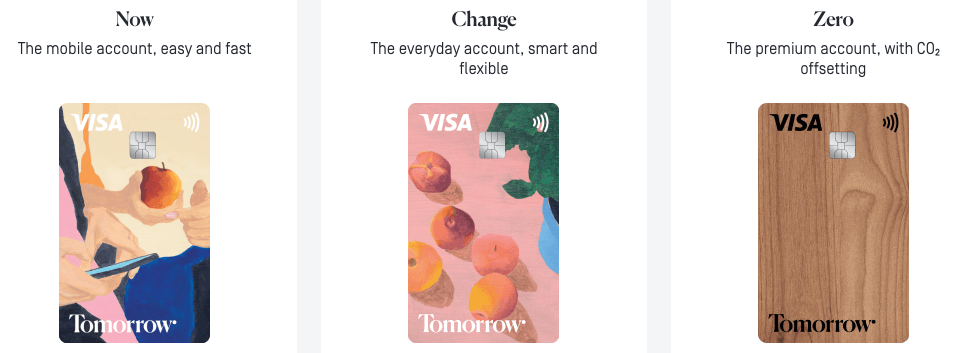

The types of accounts: Tomorrow offers three types of accounts: Now, Change, Zero. We’ve outlined all three accounts below, but here is a quick overview!

With every account you will get:

Tomorrow Free is their free bank account. This is a great account if you’re looking to familiarize yourself with their sustainable banking platform.

Tomorrow Together is a paid bank account that allows you to share an account with someone. Along with the shared account feature, there are a few other upgrades that we’ve outlined below. Together costs €5 per month.

Tomorrow Zero is their premium bank account that comes with a beautiful wooden debit card. The biggest benefit of this account is that your carbon emissions will be offset, so you can fulfil your personal net-zero carbon emissions standards. The majority of the account fees will be allocated to projects that promote sustainability. There are a few other perks to this card that we’ve mentioned below.

Read more about all differences between these different accounts here.

Who they work with:

Tomorrow is a Certified B Corp. They’ve partnered with Solaris bank – which provides the banking-as-a-service platform. They also partner with organizations like ClimatePartner to facilitate carbon offset projects – for example, when you purchase your morning cup of coffee, they will allocate a portion of the profits they earned from the “interchange fee” towards planting a tree to offset the carbon emissions.

How do you set up an account?

According to their website, the application process only takes 8 minutes. To apply:

Downsides:

This product is a great mobile-first banking product for everyday use. But, they don’t have the banking infrastructure to support investments, loans, nor credit cards. It is still nearly impossible to find a sustainable banking platform that does support those three banking features. If you are looking into these types of products, check out our broker account, loan, and credit card pages.